Painstaking Lessons Of Info About How To Reduce Your Car Payment

Tell us the make, model, and color of the vehicle you're looking to buy.

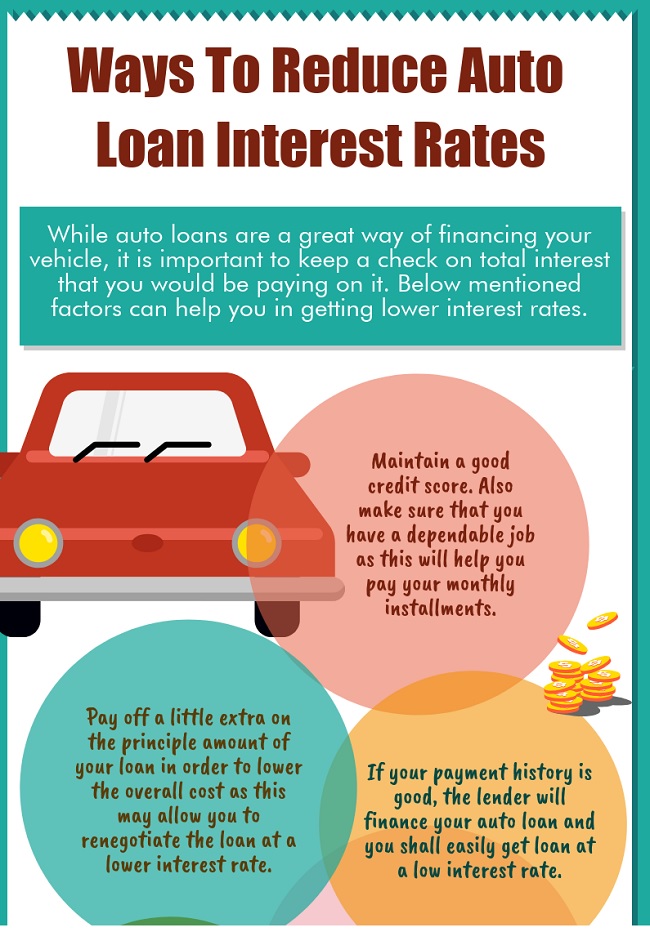

How to reduce your car payment. If you’re constantly finding it hard to make your car loan payments, refinancing may be the best option. Factors that affect car insurance rates your policy and deductibles. Refinancing allows you to replace your current loan with a new one and hopefully lower your car payment in the.

Refinance your car for longer term an extended loan term is another way to lower your car payment, even if you can’t qualify for a more competitive interest rate. You can get a lower interest rate with the same term remaining on your current loan,. Refinance your loan to get a lower interest rate 2.

One of the simplest and most effective ways to reduce your monthly payments is to refinance your car loan — if you can qualify for a new one. How to lower your car payment. Tell us about the quote you received, including.

There are two ways refinancing your car loan can help lower your monthly payment. Often you need to specify to the lender that the. If you want to earn even more for your ride, consider selling it privately.

Tell us which dealership you would like to negotiate with. When you are choosing your car insurance deductible and coverages, the specifics play a role in your monthly payment. If you didn't compare multiple offers or your.

Under refinancing, you might be able to lower your interest rate if you’ve made all of your. Depending on your vehicle’s make and model, where you live and the type of alignment your car needs, you should expect to pay from $100 to $200. A quick and easy way to lower your monthly car payment is to stretch the terms.

/AdobeStock_57359763-3a1a0a1285064dde8173ecf2c5cc4a0e.jpeg)