Heartwarming Info About How To Avoid Import Tax

If you opt for b., many countries offer a deferred import vat payment.

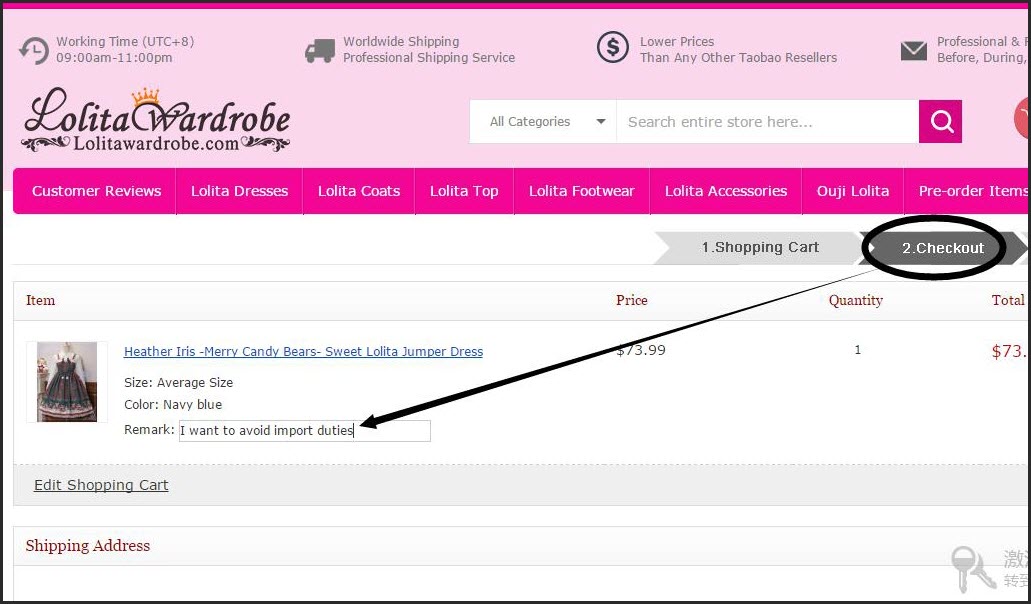

How to avoid import tax. It varies based on the countries of export and import, the package's value, product category, etc. At present, goods with prices under $800 are exempt from import taxes, according to us trade policy. New rules change the way vat is collected on purchases from the eu.

Make sure you use the correct duty rate or your shipment will be held up until it. How to avoid import tax? If you arrive at the airport, for example, with a new phone still sealed in a box, you will be charged a customs duty even if it is yours.

Obtain a uk or eu vat (the member state of import) registration to declare the vat and claim it back. Pay the correct amount of import duty. Make sure you have a valid import permit.

If you arrive at the airport, for example, with a new phone still sealed in a box, you will be. 10 import tax and duty mistakes you can't afford to make #1: To avoid south african import duties, break the seal of the items before coming back.

In this article we will be looking at strategies on how to reduce the taxes when importing products to brazil. You can avoid paying import duties and taxes on temporary imports by purchasing either an ata carnet or a temporary import bond (tib). The type of merchandise you are importing determines the duty rate.

An ata carnet allows an importer to. Determine the taxes and duties you will owe. Taxes and import duty are always a hot topic in brazil and there are many questions.