Ace Tips About How To Keep Good Business Records

Business records you need to keep 1.

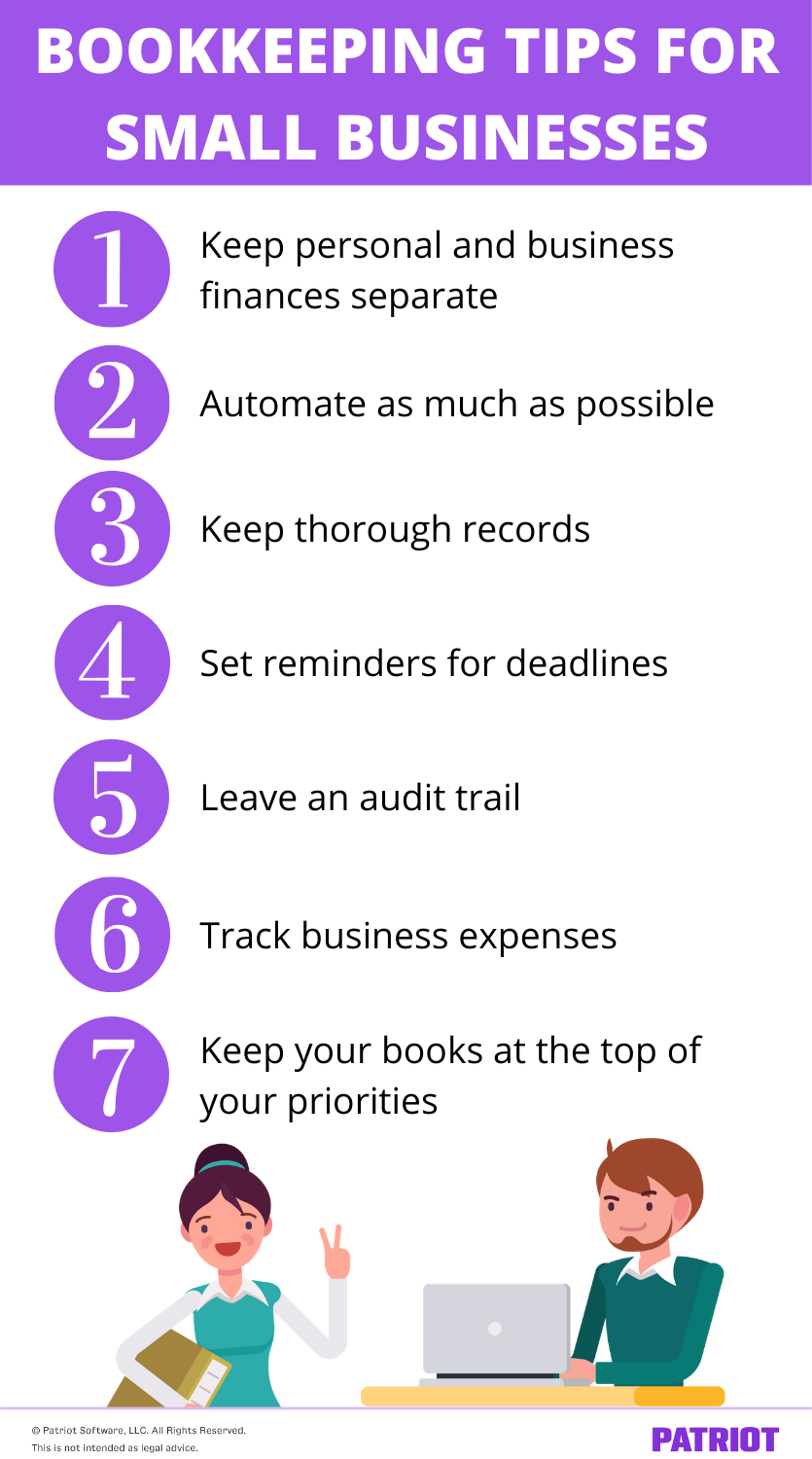

How to keep good business records. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of income,. Maintaining good records for your business not only helps to meet your tax and legal obligations, but it can save you money. You may need them for audits, legal disputes, lease applications,.

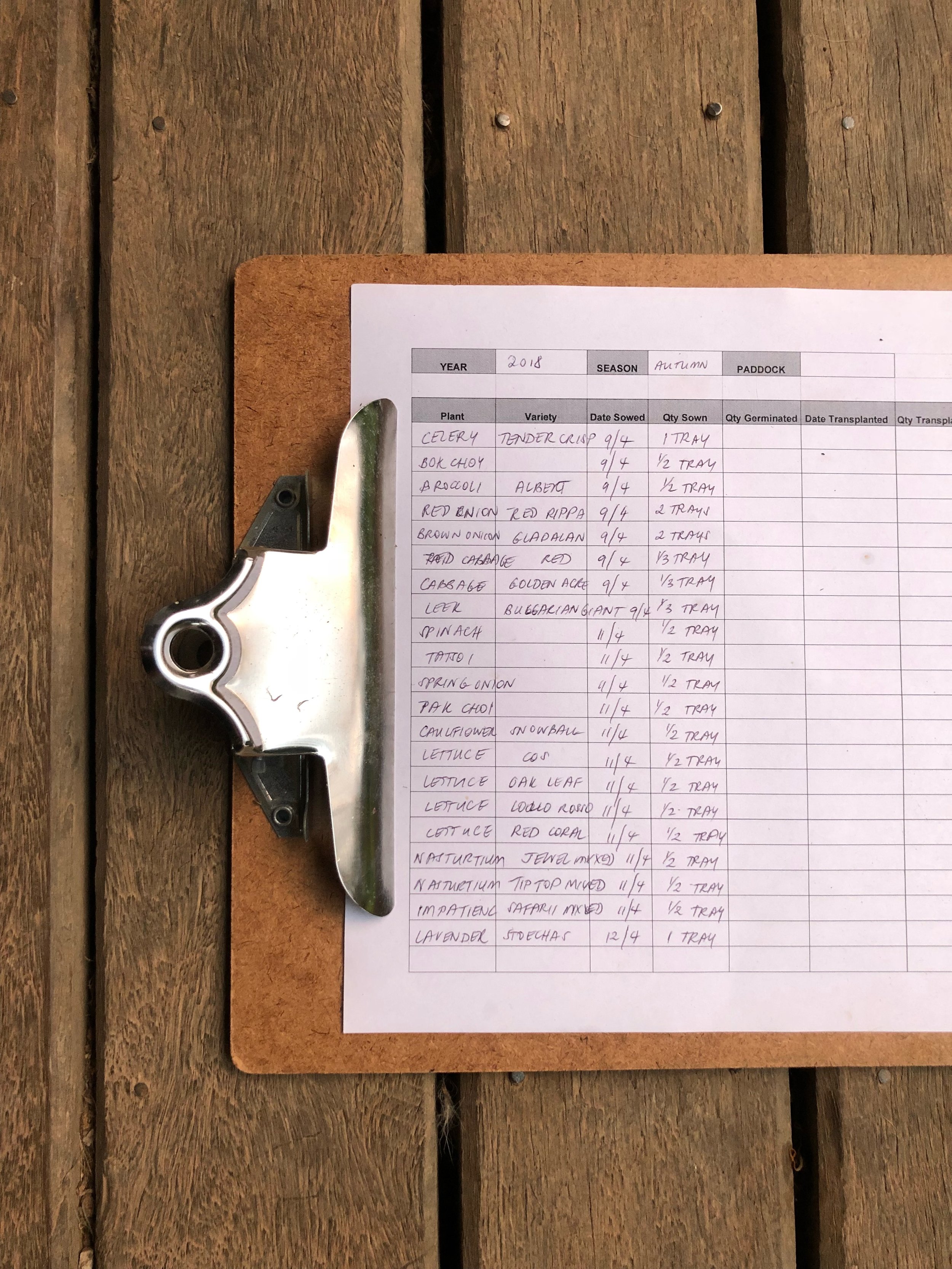

The type of business records you need to keep is directly related to the type of business you have. Keeping good records is very important to your business. Keeping good records is good business.

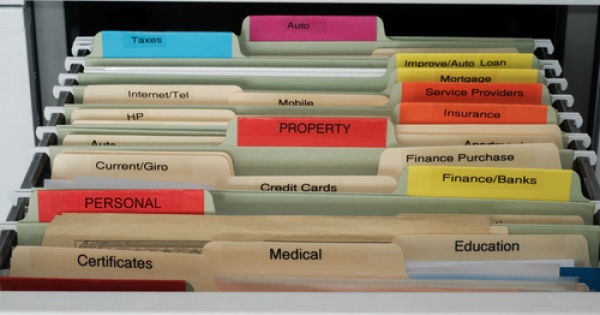

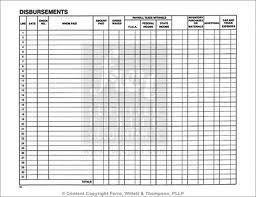

You can keep records electronically or in paper form. For both small and large businesses, a good recordkeeping system should include a summary of your business transactions. Keep records for six years if you do not report income that you should report and it is more than 25% of the gross income shown on your return.

Why should i keep records? Good records will help you do the following: According to the internal revenue tax code, you must keep your records as long as they may be needed for the administration of any part of the tax code.

Hmrc requires business owners and sole traders to keep good business records so the correct amount of tax can be calculated and paid. [1] corporations will have different. Assess the type of business you have.

Keep records indefinitely if you do. The ato recommends that businesses use electronic record keeping if possible, as they are progressively moving towards. On this gov.uk page, hmrc makes it clear that.